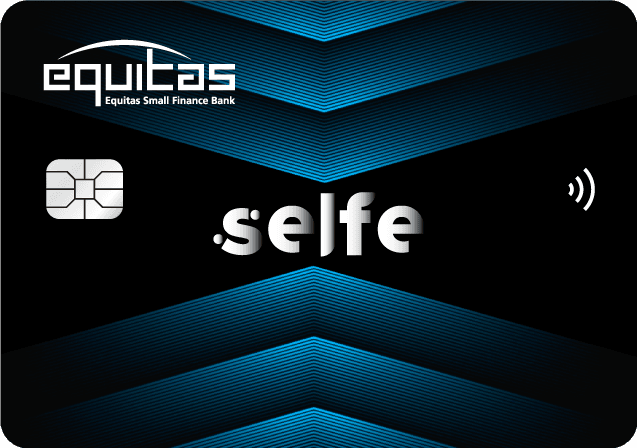

Selfe

Credit Card

Experience the Power of Choice!

Selfe

Credit Card

Experience the Power of Choice!

Selfe Credit Card – Apply Online for Interest Free & 5X Reward Benefits

The Equitas Selfe Credit Card is a digital-first card that can be applied for online without paperwork. It offers interest-free periods, attractive 5X rewards on spends, and easy online management, making it an ideal choice for customers seeking a seamless and rewarding credit card experience.

Key Features

Your Choice Matters!

Choose your Selfe

Equitas Selfe Credit Cards are available in 3 unique design options that reflects your personality.

Regular Card

Our classic blue plastic credit card boasts a sleek, minimalist design and comes with no additional fees, making it a practical choice for your financial needs.

Green Card

Support for a better tomorrow by choosing our Recycled Plastic Credit Cards. Eco-friendly Credit cards reduces the use of plastic by offering a more sustainable replacement of the plastic cards.

Metal Card

Elevate your choices by adding Metal Credit Card in your wallet. Enjoy all the features of Equitas Selfe Credit Card with the power of Metal in your hand.

Benefits

Know More About Your Card

FAQs

TIGA Credit Card

Category: Lifestyle & Rewards Card

Best for: Everyday spending, short-term EMI flexibility

Key Highlights:

• Pay by Three: Automatically converts eligible transactions on select merchants* into 3-month low cost EMI.

• 3X Rewards on UPI, Contactless payments & Pay by Three merchants — earn faster on everyday spends.

• Annual Fee: First Year Free (subject to bank’s conditions), Rs 500 from subsequent years.

• Joining Perks: Introductory low-rate EMI (0.99% for the 1st three months) & high rewards on initial spends.

• Introductory APR: 0.99% PM for the first 3 months from card open date.

• Pay by three merchants – TATA Cliq, Tony & Guy, Tony & Guy Essentuals, SLAM, Netmeds, Skull Candy, 1% Club, Prashanti Sarees, Wedtree, Lectrix

• Eligibility Criteria: Annual income of Rs 4.2 – 5 lakhs.

Ideal For:

People who want flexibility to split purchases into EMIs and earn extra rewards on UPI and tap-to-pay transactions.

- SELFE Credit Card

Category: Customizable Rewards Card

Best for: Users who want choice & entertainment benefits

Key Highlights:

• Choice of Memberships: Pick 2 premium memberships from popular brands (e.g., Amazon Prime, Jio, Hotstar, Sony LIV, Zee5, Discovery+) — as part of your joining benefits.

• Choice of Accelerated Rewards: Get 5X rewards on any 2 categories of your choice from Apparels, Dining, Utility, Grocery & Taxi.

• Choice of Card Style: Personalize your card design. Choose between Regular, Green (Eco Friendly) & Sleek Metal Card.

• Choice of billing cycle: Enjoy flexible billing cycle. Choose a billing cycle that works best for you – 12th, 16th or 20th of every month.

• Choice of network: Choose your network between VISA & Rupay

• Travel Benefits: Enjoy one complimentary domestic lounge per calendar quarter.

• Annual Fee: First Year Free (conditions apply).

• Customizable Experience: You choose what benefits matter most to you.

Ideal For:

Those who like personalization, digital subscriptions, and flexible reward categories to maximize value.

- Power Miles Credit Card

Category: Travel & Air Miles Card

Best for: Frequent flyers and travel enthusiasts

Key Highlights:

• Get a premium metal card

• Enjoy luxury memberships with Club Marriott and EazyDiner.

• Get 3X rewards on International Spends

• Complimentary Airport Lounge Access at select domestic lounges (2 per calendar quarter) and International lounge (1 per calendar quarter)

• Accelerated Rewards on travel-related spends — flights, hotels, and more.

• Annual Fee: First Year Free (conditions apply).

• Insurance Benefits: Complimentary travel accident and lost card liability cover.

• Xchange brands: 1:1 exchange on Apple imagine, Tanishq, Taj, M&S, The Body Shop. Convert your reward points to leading airline miles for flights and upgrades.

• 3RPs for every Rs 100 spent.

Ideal For:

Customers who travel frequently and want to accumulate travel points for flight tickets and enjoy airport lounge perks.

Features:

Focus: Tiga - Everyday EMI & Rewards | Selfe - Customizable Rewards & Memberships | PowerMiles - Travel Rewards & Lounge Access

Special Benefit: Tiga - Pay-by-Three EMI | Selfe - Choice of 2 Premium Memberships | PowerMiles - Convert Points to Air Miles

Reward Type: Tiga - 3X on UPI & Tap | Selfe - Choose Reward Category | PowerMiles - Accelerated on Travel

Annual Fee: Tiga - 1st Year Free | Selfe - 1st Year Free | Powermiles - 1st Year Free

Ideal For: Tiga - Flexible Spenders | Selfe - Lifestyle / OTT Users | Powermiles - Frequent Travelers

Equitas uses a rewards portal called Xchange (xchange.equitasbank.com) for redeeming reward points.

You can redeem for products, vouchers, flight / hotel booking, etc. The card’s Terms & Conditions / MITC specifies the catalogue, valuation, and conditions for redemption.

The exact value per point / the minimum points required / where you can redeem depends on which card you have and which redemption option (product, voucher, travel) you select.

Visit the Equitas Bank Website’s Credit Cards section.

Choose the variant (TIGA, SELFE or PowerMiles) and click “Apply Now.” Or by giving missed call 1800 103 2977

You will be asked to provide KYC, identity, address, income proofs, etc., to complete an online / offline application form. (Standard card application flow implied)

The bank will verify your eligibility and documents and, if approved, dispatch the card. (You may also need to activate it with first transaction or PIN setup)

The application flow and decisioning may be instantaneous or take some time depending on internal checks.

Here are the main benefits per card, plus general advantages:

TIGA Card Benefits

• 3× rewards on UPI, contactless payments, and on Pay-by-3 merchant spends

• “Pay by 3” — eligible transactions with select merchants can be auto converted into a 3-month low cost

EMI

• Up to 50 days of interest-free credit period for regular purchases

• Fuel surcharge waiver: 1% waiver on fuel transactions (within certain transaction bands)

• Insurance / protection covers: air accident, credit shield, lost card liability etc. (for primary cardholder)

SELFE Card Benefits

• Choice of 2 memberships (Amazon Prime, Jio/Hotstar, Zee5, Sony LIV, etc.) as part of your benefits. Choice of 2 reward categories out of five (Apparel, Dining, Grocery, Utility, Taxi) where you’ll earn 5× points

• Standard rewards on all other spends

• Up to 50 days interest-free credit on regular purchases

• Fuel surcharge waiver, insurance covers, and domestic lounge (1 per quarter) benefit for SELFE

PowerMiles Card Benefits

• Premium metal card, luxury memberships (Club Marriott, EazyDiner) included

• Lounge access (domestic + international) depending on card rules

• 3× rewards on international spends, plus ability to convert points to airline / hotel miles

• Fuel surcharge waiver, detection and Xchange program redemption options.

General Advantages

• Flexibility of interest-free credit period (if you pay full within due date)

• Rewards / points for your everyday spending

• Perks like fuel surcharge waiver, insurance, lounge access (for premium)

• Ability to convert large purchases into EMIs (for TIGA)

• Multiple redemption options via Equitas’s rewards portal

Yes, the Equitas “Most Important Terms & Conditions (MITC)” document lists several fees, and redemption governed by reward programme rules.

Key points:

• Joining / Annual Fees

• TIGA: ₹500 (joining) + ₹500 (annual)

• SELFE: ₹1,000 joining + ₹1,000 annual

• PowerMiles: ₹5,000 joining + ₹5,000 annual

• Cash Advance / ATM Withdrawal Charges

2.5% of the amount withdrawn (or ₹250, whichever is higher). Also, finance charges apply from day of withdrawal till full repayment.

• Other Charges / Fees

• The bank may levy other charges (late payment, over limit, return of payment, etc.) as per the Schedule of Charges in the Card Agreement / MITC.

• • Redemption handling / administrative charges (if any) would be specified in the rewards programme terms (the MITC / catalogue) — it is possible that some redemptions may carry a small fee or conversion cost. (I didn’t find a publicly explicit “redemption fee” in the MITC I reviewed, so you will need to check the latest catalogue or rewards terms)

• Waiver of Annual Fee

• TIGA: The annual fee may be waived if you spend a certain threshold in the anniversary year (as per terms)

• SELFE: Similarly, waiver if you cross a spending threshold (e.g., ₹2,00,000) in the year.

• PowerMiles: Waiver available if you spend a defined amount (e.g. ₹4,80,000) in the anniversary year.

So yes — while redemption may not always incur a direct separate fee (depending on the option), there are various fees built into the cards’ terms, and you must see the “Schedule of Charges / rewards programme” for your card variant.

Register a complaint through the following ways:-

Selfe loan app

Customer care helpline number 1800 103 2977

Write to customerservice@equitas.bank.in from your registered mail id

You can also lodge a complaint at RBI’s Sachet Portal

Blogs